- 한국어

- English

- 日本語

- 中文

- العربية

- Español

- Français

- Deutsch

- Pусский

- Tiếng Việt

- Indonesian

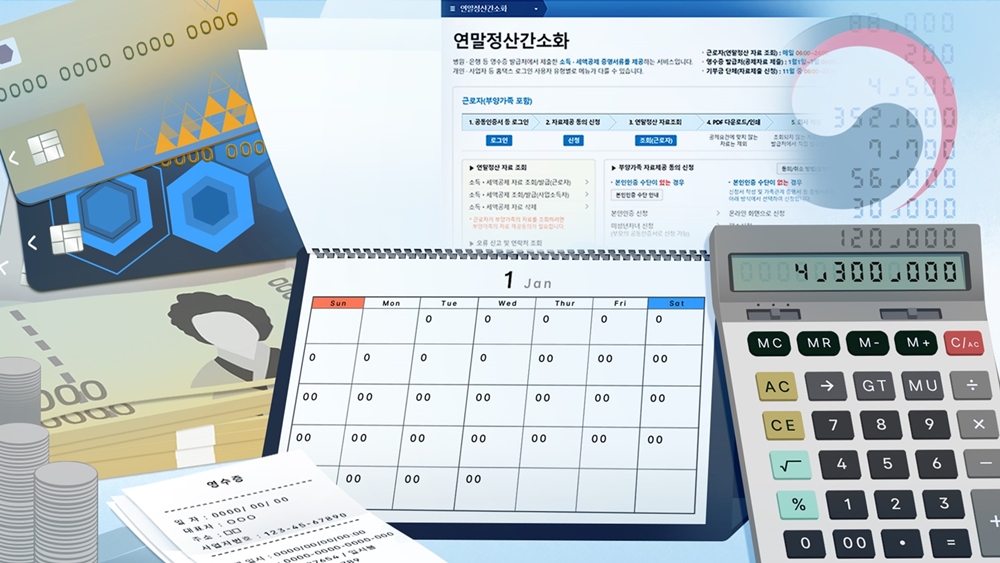

Foreign workers must file their annual tax returns by late February for income earned last year. (Yonhap News)

By Gil Kyuyoung

Foreign workers must file tax returns regardless of nationality or length of stay.

The National Tax Service (NTS) on Jan. 6 urged such workers to file by late February for income earned last year.

In principle, the year-end tax settlement schedule, deductions by category and tax calculation methods remain the same for both domestic and foreign workers. The income deduction for the amount of housing savings deposit, however, does not apply to expats who cannot be the head of a household under the Resident Registration Act given the related requirement.

For 20 years starting with the tax year in which they started working in Korea, foreign laborers can choose between an annual flat tax (19%) and the basic rate of the comprehensive income tax. Should they choose the former, they are ineligible for tax exemptions, deductions, reductions or credits under the Income Tax Act.

Foreign technicians who meet the requirements for engineers or researchers qualify for an earned income tax deduction of 50% for 10 years. Native-speaking language teachers may receive exemption from income tax based on tax treaties.

The NTS offers more information through an English-language guide on the agency's English-language website, manuals in English, Chinese and Vietnamese, YouTube channel and hotline for foreign nationals (1588-0560).

"We are verifying the practicality of tax reporting after finishing year-end tax settlements," the NTS said. "Please refer to information given to foreign workers so that they avoid additional taxes (up to 40%) due to wrong deductions."

gilkyuyoung@korea.kr