Korea strives toward a completely open market by removing trade barriers through free trade agreements (FTAs). In 2015, the country opened its rice market, thus completely opening up its agricultural sector to full international competition.

Under the slogan “Small National Territory, Big Economic Territory,” Korea has plans to sign FTAs with most countries across the world. As of 2017, Korea signed FTAs with 52 countries, including Chile, the European Free Trade Association (EFTA), the Association of Southeast Asian Nations (ASEAN), India, the European Union (EU), Peru, the United States, Türkiye, Australia, Canada, China, New Zealand, Vietnam, and Colombia. In addition, in 2017, the country initiated an FTA with five Central American countries—Costa Rica, El Salvador, Nicaragua, Honduras, and Panama.

In addition to opening its markets, Korea encourages foreign direct investments (FDIs). To that end, the country enacted the Foreign Investment Promotion Act. In Korea, FDI refers to a foreign entity acquiring 10% or more equity share of a domestic business through an investment of not less than KRW 100 million, or a foreign—based business borrowing of a long—term (5 years or longer) loan from its parent business located in a foreign country.

Under the Foreign Investment Promotion Act, the government guarantees the profits earned by foreign investors and offers them a variety of benefits such as tax incentives, cash support, and mitigation of land—related regulations. In addition, the country also has mechanisms to protect their intellectual property rights and foreign exchange transactions. Thus, the Act ensures that foreign investors are allowed to take the profits they earn in Korea out of the country, on the basis of creative and efficient operation.

Specifically, foreign investors are eligible for support from the Korean government concerning the land required for the establishment of factory or research facilities, the purchase or lease or construction of a building, or the installation of electric or communication facilities. Furthermore, they may be eligible for installment payments for up to 20 years in cases of purchasing land owned by either the central or local government.

In addition, the Korean government also provides cash support based on the amount of FDI and the number of local employees to be hired. The government is ready and willing to provide both land and capital if a foreign business displays excellent technological prowess and maintains a certain number of local employees. FDI serves as an indicator representing a country’s standing in the international finance and commerce arena.

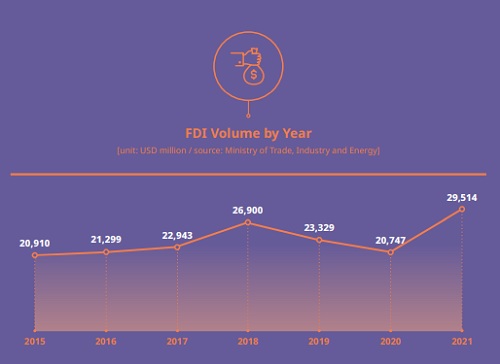

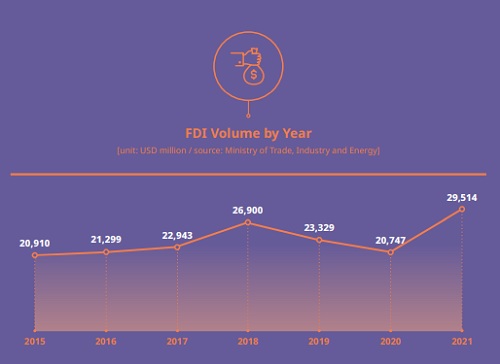

The profits earned by foreigners investing in Korea are used as a metric to predict the country’s economic potential going forward. FDI in Korea surged right after the foreign exchange crisis in 1998, with the increasing trend continuing.

The reported amount of FDI as of 2021 stood at USD 29.5 billion. The government continues to improve the system for the provision of support to foreign investors. In October 2010, the government lowered the thresholds for cash support for foreign investors and expanded the scope of state/municipality-owned land eligible for private contracts in a bid to foster favorable conditions for FDIs. In 2014, Korea amended the Enforcement Rules of the Foreign Investment Promotion Act and the Enforcement Decree of the said Act to establish the criteria for the recognition of headquarters and R&D facilities of global enterprises. In 2016, the country amended the Foreign Investment Promotion Act to streamline the registration procedures for foreign investments, which had previously differed depending on the type of investment. The government plans to adjust its policies in support of foreign investors and Korean companies that are shifting their investment focus back to Korea, known as ‘U-turn companies,’ in order to promote job creation.

Under the slogan “Small National Territory, Big Economic Territory,” Korea has plans to sign FTAs with most countries across the world. As of 2017, Korea signed FTAs with 52 countries, including Chile, the European Free Trade Association (EFTA), the Association of Southeast Asian Nations (ASEAN), India, the European Union (EU), Peru, the United States, Türkiye, Australia, Canada, China, New Zealand, Vietnam, and Colombia. In addition, in 2017, the country initiated an FTA with five Central American countries—Costa Rica, El Salvador, Nicaragua, Honduras, and Panama.

In addition to opening its markets, Korea encourages foreign direct investments (FDIs). To that end, the country enacted the Foreign Investment Promotion Act. In Korea, FDI refers to a foreign entity acquiring 10% or more equity share of a domestic business through an investment of not less than KRW 100 million, or a foreign—based business borrowing of a long—term (5 years or longer) loan from its parent business located in a foreign country.

Under the Foreign Investment Promotion Act, the government guarantees the profits earned by foreign investors and offers them a variety of benefits such as tax incentives, cash support, and mitigation of land—related regulations. In addition, the country also has mechanisms to protect their intellectual property rights and foreign exchange transactions. Thus, the Act ensures that foreign investors are allowed to take the profits they earn in Korea out of the country, on the basis of creative and efficient operation.

Incheon Airport as a Hub Airport

Incheon Airport is a regional hub airport, where all airplanes around the world can be operated for 24 hours without worrying about weather condition. In Northeast Asia, the main regional hub airports include Kansai Airport in Osaka, Chek Lap Kok Airport in Hong Kong, Pudong Airport in Shanghai, and Incheon Airport in Korea.

Specifically, foreign investors are eligible for support from the Korean government concerning the land required for the establishment of factory or research facilities, the purchase or lease or construction of a building, or the installation of electric or communication facilities. Furthermore, they may be eligible for installment payments for up to 20 years in cases of purchasing land owned by either the central or local government.

In addition, the Korean government also provides cash support based on the amount of FDI and the number of local employees to be hired. The government is ready and willing to provide both land and capital if a foreign business displays excellent technological prowess and maintains a certain number of local employees. FDI serves as an indicator representing a country’s standing in the international finance and commerce arena.

The profits earned by foreigners investing in Korea are used as a metric to predict the country’s economic potential going forward. FDI in Korea surged right after the foreign exchange crisis in 1998, with the increasing trend continuing.

The reported amount of FDI as of 2021 stood at USD 29.5 billion. The government continues to improve the system for the provision of support to foreign investors. In October 2010, the government lowered the thresholds for cash support for foreign investors and expanded the scope of state/municipality-owned land eligible for private contracts in a bid to foster favorable conditions for FDIs. In 2014, Korea amended the Enforcement Rules of the Foreign Investment Promotion Act and the Enforcement Decree of the said Act to establish the criteria for the recognition of headquarters and R&D facilities of global enterprises. In 2016, the country amended the Foreign Investment Promotion Act to streamline the registration procedures for foreign investments, which had previously differed depending on the type of investment. The government plans to adjust its policies in support of foreign investors and Korean companies that are shifting their investment focus back to Korea, known as ‘U-turn companies,’ in order to promote job creation.